Making sense of investment fees

By: Julio Cacho, PhD & Juan Carlos Herrera

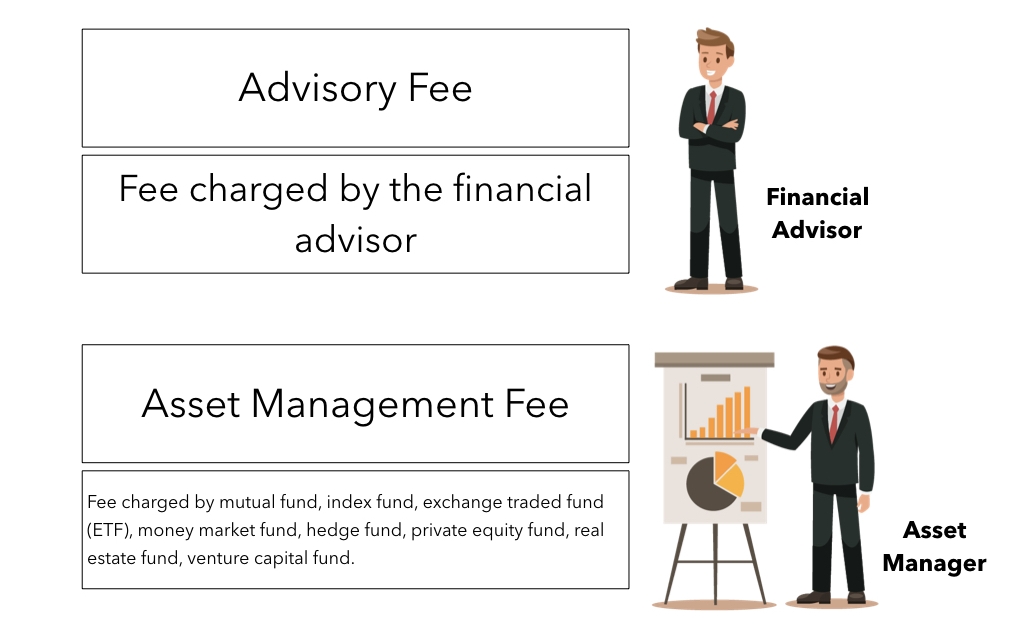

Did you know that when people hire a bank financial advisor, or an independent financial advisor to help them with their investments they have to pay at least two layers of fees? At a minimum people must pay an asset management fee and an advisory fee.

Meanwhile, passive funds, investment funds aimed to track a stock market index, have squeezed margins and profits across the asset-management industry since their introduction by Vanguard in 1975. Recently, Fidelity introduced two zero-cost tracker funds that require no minimum investment and an expense ratio (that is, net cost to investors) of zero. Such funds will further shake up the asset management industry that has long relied on stock pickers to actively manage funds.

The introduction of these Fidelity zero-cost funds highlights how much active share management is hurting. In 2017 people paid an average of 0.57% in active management fees even though 87% of actively managed U.S. equity funds in the past decade have underperformed their benchmark indices. Please see below for sources.

The fees for mutual-funds and index-funds keep falling. Trading is free, depending on where you do it. Furthermore, technology is helping to lower the cost of delivering advice, putting pressure on standard fee models. To date, the only holdouts in the race to rock-bottom fees have been traditional investment advisors. However, that is slowly starting to change.

Two reasons the decline has so far been slow-moving is a lack of disclosure and the fragmented nature of the business. There isn’t one set rate that any firm or advisor charges clients; advisors have leeway in what they charge from one client to the next. People often choose financial advisors without truly knowing what they are paying for.

No one suggests that financial-advice fees will go literally to zero anytime soon. Many investors will always pay because they think it’s worth it. And some investors will always value a relationship with a human advisor enough to pay a bit more than what they otherwise might for digital advice or to manage their own investments.

As advisors work to justify fees of 1% or more, many are pitching clients on their ability to offer financial advice that goes beyond solely investment allocation. Some say they can handle taxes, advise on business, prepare clients for retirement years, plan for their children’s educations, and deliver more specialized services. Still, some experts warn that investors will want their advisors to offer those services a la carte, letting clients pay for what they want and leave what they don’t.

Given the increasing options for low-to-zero cost passive funds, it might be time to consider an advisor as more of a coach rather than strictly as an asset manager. The expertise and services that advisors offer would still benefit most clients.

In this way of thinking, perhaps advisory fees should depend on the complexity of the investments and not on the size of the assets being managed. In other words, perhaps advisors should be paid a flat fee instead of a percent of the assets under management. An advisor can then be paid like a coach or a consultant without the investor paying 1% or more on the assets being managed.

What do you think? Feel free to comment below.