Does a Financial Advisor add Value? It Depends.

By: Julio Cacho, PhD

That may sound like a wishy-washy answer to a common question: Is it worth it to pay a financial advisor to help me with my investments? But it’s true—there is no cut-and-dry answer. It really does depend on a handful of key variables nicely summarized in a recent Morningstar column. Here, I’ll present my own summary, along with a few additional thoughts.

Fees:

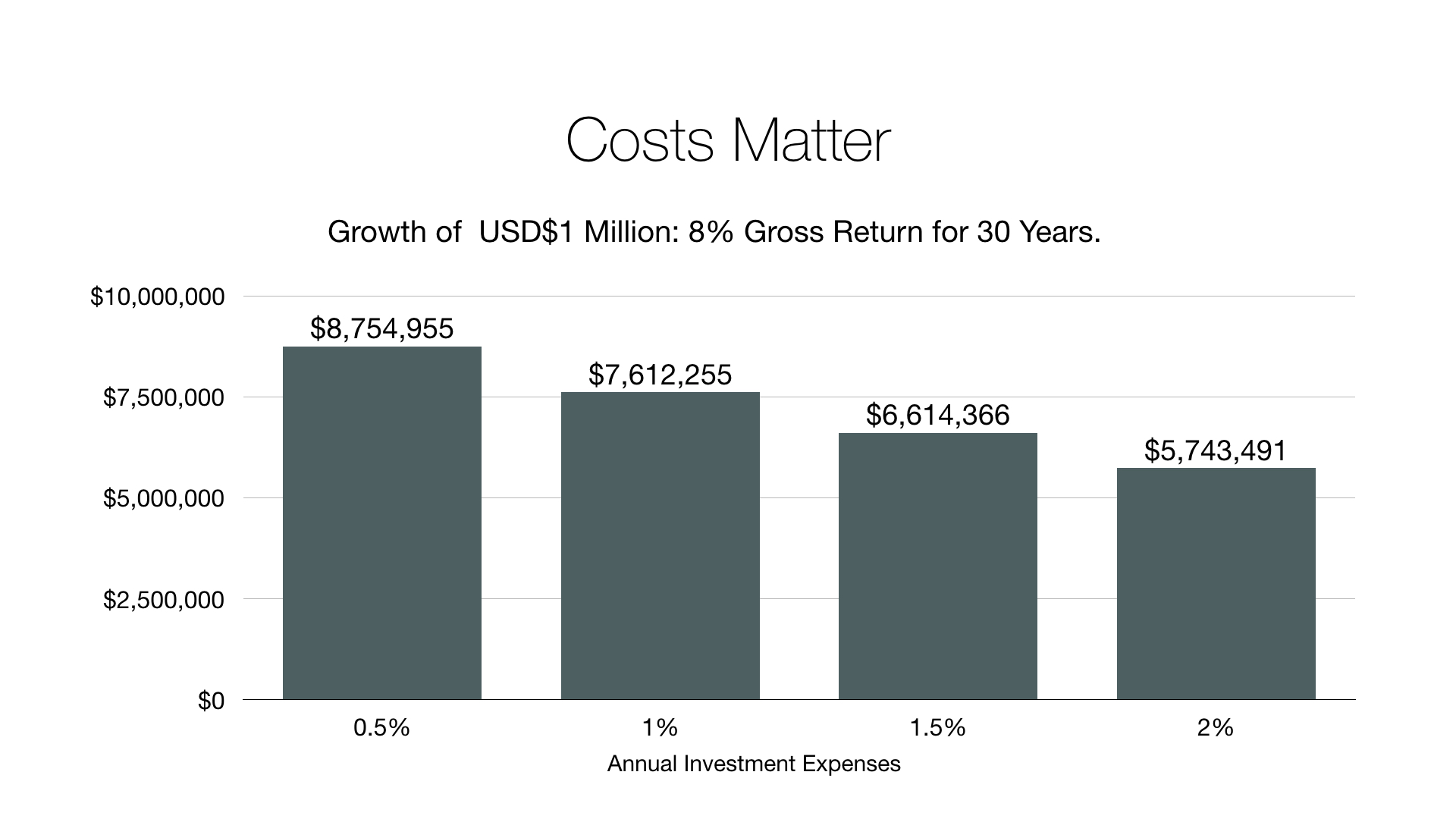

One of the first rules of smart investing is to be prudent about fees—whether that’s the fee a financial advisor charges you, or the range of fees (some more obvious than others) associated with mutual funds and other popular investments. The chart below shows how much fees impact your portfolio over time.

So in researching a financial advisor, find out how they assess their fees. As a general rule-of-thumb, look for advisors who advertise themselves as “fee only.” Such advisors steer clear of commissions that can create a conflict of interest. A 2017 Department of Labor rule attempted to designate all financial advisors as “fiduciaries”—someone with a legal obligation to act in the client’s best interest. Although the proposed rule was struck down in court last year, it helped encourage a trend away from commissions. The National Association of Personal Financial Advisors (NAPFA) has adopted a fee-only philosophy since 1982.

Fees are inseparable from the question of the kind of advice you’re looking for. An investment advisor can give you advice about a specific investment, or actively manage an entire portfolio. A financial planner, on the other hand, will advise you about a range of other issues—including budgeting, retirement planning, and insurance. Some offer a mix of both services.

Understanding your own skills and knowledge about investing is critical and figures into both of the above questions. If you’re fairly knowledgeable and just want an independent sounding board, a flat, fixed fee might be appropriate. If you’d rather have a professional manage your overall portfolio, an Assets Under Management (AUM) fee structure might be the way to go.

Credentials: Warning! The barrier of entry to give financial advice is very low!

Once you have a clear idea of the type of help you want, you should then assess the advisor’s skill level and credentials. I cannot stress enough how important and overlooked this part of the advisor evaluation process is. Unlike medical doctors, attorneys, and even CPAs, which require years of intense studying in order to perform their services, there is a very low barrier of entry to become a financial advisor. The industry has done a great job giving fancy titles like “Wealth Strategist” and “Senior Vice President” to financial advisors who are great salespeople, but lack the deep understanding and knowledge required to give sound investment advice. Ensuring your financial advisor has a thorough understanding of the financial markets is just as important as your medical doctor having a robust understanding of medicine.

Investment philosophy and your emotions.

It is also important to find the right philosophical fit. Are you a young investor looking to aggressively beat the market? Or are you looking to conservatively manage the nest egg you’ve already accumulated? Here, we come to the final variable—your life stage. As a general rule, we spend the first decades of our working lives accumulating wealth, and then gradually transition to a more conservative effort to protect and manage that wealth.

Further, it’s important to find the right fit between your situation—your own investing knowledge and skill level, your financial needs and objectives, the kind of investments you’re comfortable with—and the expertise, fee structure, and investing philosophy of your prospective advisor. In other words, once you understand your needs and what you’re looking for, you’ll be able to make a clear-eyed judgment about the kind of advice you want, and how much you’re willing to pay for it.

The emotions of investing are real, unavoidable, and should be taken seriously. I cannot tell you how many times I’ve told a client that he or she could be down a given percent at any moment, and the client assures me that he or she can handle the decline, but then when it actually happens, the client’s emotions take over and genuine panic takes control. Knowing what your investing in, and sticking to your investment plan regardless of what’s happening day-to-day in the market, is crucial to your long-term success.

Should you hire a financial advisor? As one myself, my biased answer is yes, but not for the reasons you might expect.

As Nobel Laureate, Daniel Kahneman, wrote in his book Thinking Fast, Thinking Slow: “Although humans are not irrational, they often need help to make more accurate judgements and better decisions. [They] also need protection from others who deliberately exploit their weaknesses […].”

The value of a financial advisor does not come from the advisor picking the best fund manager, stock, or bond, and it’s certainly not who can recommend the next “sure thing” or the next “exclusive” private investment. Instead, it’s someone who has a deep understanding of economics and the capital markets, the costs of investing, and most importantly, the fortitude to be your trusted coach, mentor, teacher, and psychologist. In the end, a great financial advisor should provide you with the discipline to stay on your carefully chosen path, and should shield you from the mostly irrelevant noise coming from the financial media, whose goal is to entertain, and the Wall Street banks, who mainly want to make money off of you, not for you.